10 Easy Facts About Henderson Reverse Mortgage - Grand Lending Group Described

Guide to Reverse Mortgages in Las Vegas - Drennen Home Loans

What Does Use Your Home's Equity With A Reverse Mortgage In Las Vegas Do?

As a general rule, the older you are and the greater your equity, the larger the reverse home loan benefit will be (as much as particular limitations, in many cases). The reverse home loan must pay off any outstanding liens against your residential or commercial property before you can withdraw additional funds. The loan is not due and payable till the debtor no longer occupies the house as a primary house (i.

Basics of reverse mortgages - Las Vegas Review-Journal

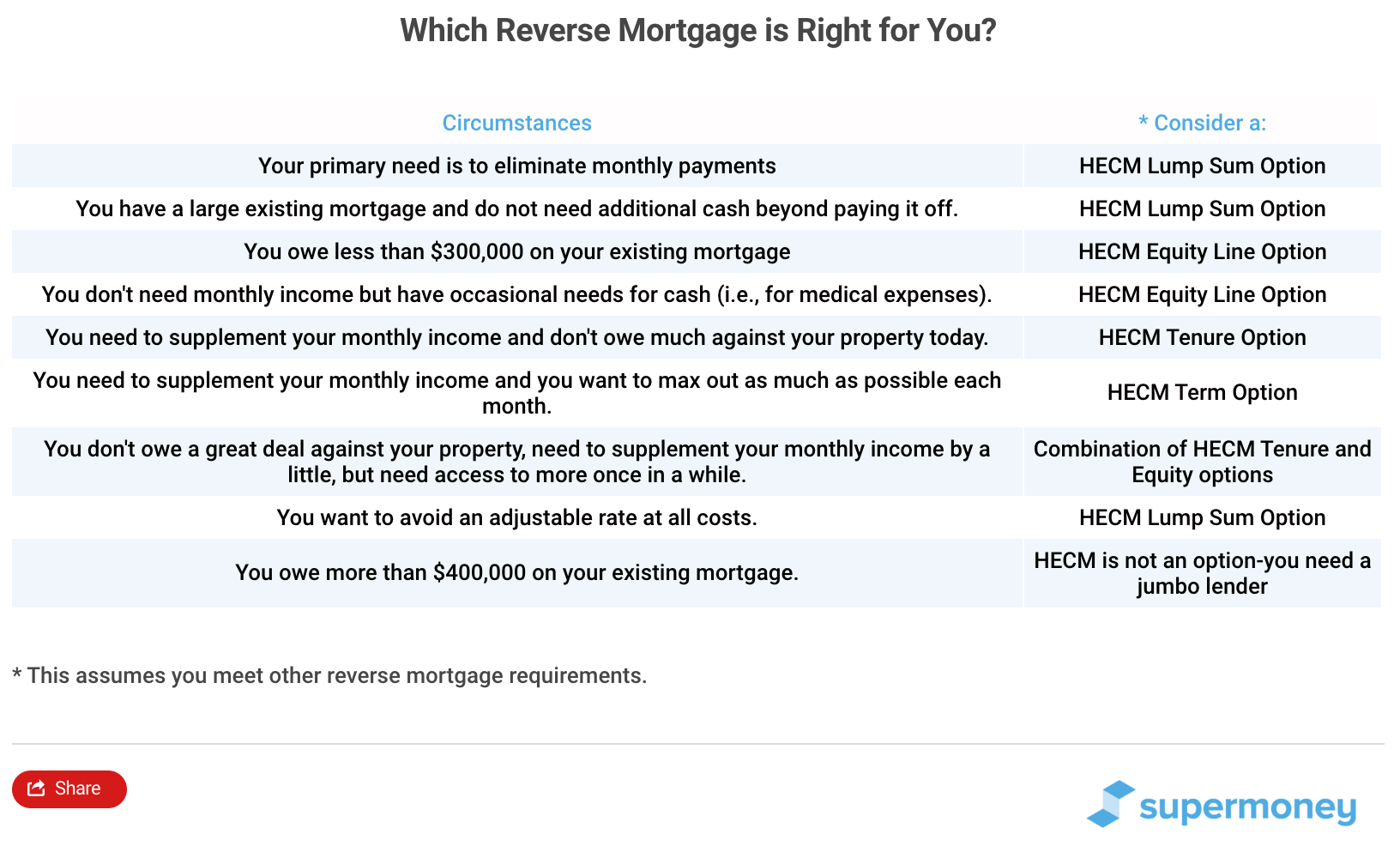

the borrower sells, leaves permanently or dies). At that time, the balance of borrowed funds is due and payable, all additional equity in the property belongs to the owners or their beneficiaries. There are three reverse mortgage products available, the FHA - HECM (House Equity Conversion Home Loan), Fannie Mae - Home, Keeper, and the Cash Account programs.

Geneva Financial Welcomes New Loan Officer Alma Moreno to Nevada Market - Geneva Financial Mortgage

The Single Strategy To Use For FHA Loan - Nevada - Superior Mortgage Lending LLC

The costs related to getting a reverse mortgage are comparable to those with a standard mortgage, such as the origination fee, appraisal and examination charges, title policy, mortgage insurance and other normal closing expenses. With a reverse home mortgage, all of these costs will be funded as part of the home loan prior to your withdrawal of additional funds.

The therapist's task is to educate you about all of your home loan options. Did you see this? is at no cost to the debtor and can be performed in individual or, more usually, over the telephone. After finishing this counseling, you will get a Counseling Certificate in the mail which should be consisted of as part of the reverse home mortgage application.

NY TIRSA Reverse Mortgage Endorsement Guideline 1995 Fundamentals Explained

The most popular alternative, picked by more than 60 percent of borrowers, is the line of credit, which allows you to draw on the loan continues at any time. If a senior house owner picks to repay any part of the interest accumulating against his obtained funds, the payment of this interest may be deductible (just as any home loan interest may be).

And, in some cases, the lending institution increases the overall quantity of the line of credit with time (unlike a standard House Equity Line whose credit line is established at origination). If a senior homeowner stays in the residential or commercial property until she or he dies, his/her estate assessment will be minimized by the quantity of the financial obligation.